ASX ANNOUNCEMENT: Qualitas releases FY24 financial results

21 August 2024

RECORD CAPITAL INFLOW AND DEPLOYMENT TRANSLATE INTO HIGHER RECURRING EARNINGS AND MARGINS

Qualitas Limited (ASX: QAL) (Qualitas, or Company), a leading Australian alternative real estate investment manager, is pleased to present its financial results for the year to 30 June 2024 (FY24)1 along with financial and operational updates.

Access the ASX announcement and the presentation.

Financial Highlights:

Operational Highlights:

- Committed funds under management (FUM)4 of $8.9 billion, up 46% on FY23

- Record $2.8 billion net capital inflow, up 55% on FY235

- $4.2 billion total deployment, up by 40% on FY23

- Invested FUM of $4.4 billion, up 13% on FY236

- Fee Earning FUM7 of $6.8 billion, up 40% on FY23 including:

- Total $2.4 billion approved undrawn construction credit, which is expected to be progressively drawn and increase Invested FUM driving higher management fee earnings at an accretive margin

- Average gross investment size of $80 million8, up 10% on FY23

FY25 Guidance9:

- FY25 NPBT10 of between $49 million and $55 million, representing an increase of c.26% to c.41% respectively on FY24

- FY25 EPS10 is estimated between 11.50 cps and 12.91 cps11

Group Managing Director and Co-Founder Andrew Schwartz said:

“Our full year 2024 financial results included our highest on record net capital inflow and deployment, demonstrating the high conviction in Qualitas from an increasing number of large institutional investors. The growth of our platform is underpinned by astute borrowers who acknowledge that Qualitas can deliver superior tailored capital solutions under flexible mandates. We see significant investor demand for private credit continuing, particularly within the commercial real estate sector. It offers earnings stability in an environment where interest rates have risen and asset values are recalibrating.

We have an institutional funds management model that is differentiated by our track record, transparent and robust governance and reporting framework which is well regarded by some of the most sophisticated global institutional investors. This enables us to access large scale capital in long-dated fund structures. Equally, it underpins our ability to deploy at a scale that is difficult to replicate.

In FY24, we deployed a record $4.2 billion, predominantly in private credit. This supported a 25% growth in Normalised EBITDA3 compared to FY23, with the expansion of our funds management EBITDA margin exceeding our long-term target12. Strong operational and financial performance in FY24 has established a solid foundation for our future funds management earnings growth.

The deployment environment for our funds remains strong. We have seen signs of the next residential development cycle with off-the-plan realisation values for new projects rising and building costs moderating.

We remain confident in our balance sheet capacity and retained earnings to support co-investment and to achieve our FUM growth ambition. We are focused on optimising returns on shareholder equity by maximising underwriting and co-investment opportunities including by taking direct co-investment senior loan allocations. As a fast-growing business, our objective is to maximise the self-sufficiency of our balance sheet to support our future growth.”

Funds Management Performance

Funds management revenue grew by 22% year-on-year to $53.7 million, delivering consistent growth since listing. Our quality of earnings also improved, demonstrated by the increased contributions from recurring fee-related earnings and principal income. We also improved our scale efficiency through a 5% funds management EBITDA margin expansion to 52% compared to FY233.

Of our total deployment in FY24, 97% was in private credit and 85% was in the residential sector. Industry seasonality meant deployment was skewed to the fourth quarter of FY24, with momentum benefits to be realised in FY25, as per the above noted earnings guidance.

The ramp-up in construction credit investments in FY24 underpinned the 40% growth in Fee Earning FUM7 and highlights the potential for future earnings growth. Our pipeline continues to provide a line of sight on attractive investment opportunities in the residential construction sector.

Outlook

Qualitas is well-positioned to deliver strong growth in FY25. We expect Invested FUM will increase significantly from deployment in the prior period, as the undrawn construction facilities are progressively drawn, and from the continued deployment of dry powder. This will support the continued growth of our funds management earnings and deployment capacity in FY25.

Mr Schwartz continued:

“Looking forward, our investment pipeline gives us confidence of strong continued deployment. Having recognised the opportunity in front of us, we are growing our investment team and investing further into technology to support our next phase of growth for the business.”

With these opportunities, and based on no material adverse change in the current market conditions, our guidance for FY259 is:

- FY25 NPBT10 between $49 million and $55 million, representing an increase of c.26% to c.41% respectively on FY24

- FY25 EPS10 between 11.50 cps and 12.91 cps11

Market briefing

Qualitas’ market briefing is being held today, 21 August 2024 at 10:00am (AEST), with presenters: Andrew Schwartz (Group Managing Director and Co-Founder), Mark Fischer (Global Head of Real Estate and Co-Founder), Kathleen Yeung (Global Head of Corporate Development) and Philip Dowman (Chief Financial Officer).

Webcast

Please use the following link to access the webcast presentation: https://webcast.openbriefing.com/qal-fyr-2024/

Teleconference

Prefer to dial-in? Please pre-register using the link below and to access dial-in details: https://s1.c-conf.com/diamondpass/10039056-gh7s98.html

A replay of the webcast will be available on the Qualitas website following the conclusion of the briefing.

Authorised for release by the Board of Directors of the Company.

For further information, please contact:

| Investor Enquiries Nina Zhang Director – Investor Relations T: +61 3 9612 3939 E: nina.zhang@qualitas.com.au |

Media Enquiries Kate Stokes Head of Marketing and Communications M: +61 481 251 552 E: kate.stokes@qualitas.com.au |

Investor Website: https://investors.qualitas.com.au/investor-centre/

About Qualitas

Qualitas Limited ACN 655 057 588 (Qualitas) is an ASX-listed Australian alternative real estate investment manager with approximately $8.9 billion13 of committed funds under management.

Qualitas matches global capital with access to attractive risk adjusted investments in real estate private credit and real estate private equity through a range of investment solutions for institutional, wholesale and retail clients. Qualitas offers flexible capital solutions for its partners, creating long-term value for shareholders, and the communities in which it operates.

For 16 years, Qualitas has been investing through market cycles to finance assets, now with a combined value of over A$24 billion14 across all real estate sectors. Qualitas focuses on real estate private credit, opportunistic real estate private equity, income producing commercial real estate and build-to-rent residential. The broad platform, complementary debt and equity investing skillset, deep industry knowledge, long-term partnerships, and diverse and inclusive team provides a unique offering in the market to accelerate business growth and drive performance for shareholders.

Notes

- Comparison to FY23 refers to the twelve months to 30 June 2023 throughout this announcement.

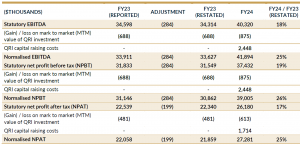

- In 2024, Qualitas discovered an accounting misstatement from when AASB 16 was adopted. The incorrect recognition of lease outgoings led to the understatement of both trade and other payables, and expenses. FY23 earnings shown are voluntarily restated with an additional $199k after tax occupancy expense included.

- FY23 normalised earnings adjusted for abnormal items, including unrealised mark-to-market (MTM) gains ($0.7m) from Qualitas’ co-investment in QRI. FY24 normalised earnings adjusted for unrealised MTM gains ($0.9m) from Qualitas’ co-investment in QRI and QRI capital raise costs ($2.4m). Please refer to Appendix A for reconciliation of restatement for FY23 financial and statutory financial to normalised financial.

- FUM represents committed capital from investors with signed investor agreements.

- Difference between FUM as at 30 June 2024 and 30 June 2023.

- Funds currently deployed. Capital drawn for equity funds. Funds drawn on live deals/loans less repayments for credit funds.

- Amount earning base management fees. Base management fee structures vary across investment platforms. Committed FUM, Invested FUM, net asset value, gross asset value, acquisition price and other metrics may be used to calculate base management fees.

- Excluding investments that are non-typical with significant size such as ‘Aura by Aqualand’ and ‘Victoria & Albert’.

- Outlook statements and guidance have been made based on no material adverse change in the current market conditions.

- Excludes any MTM movements for Qualitas’ co-investment in QRI and QRI capital raising costs.

- Based on the current total number of ordinary shares on issue, that is subject to any future changes.

- Page 12 of 2023 Investor Day Presentation.

- As at 30 June 2024.

- As at 31 December 2023.

Disclaimer

This announcement contains general information only and does not take into account your investment objectives, financial situation or needs. Qualitas is not licensed to provide financial product advice in relation to Qualitas shares or any other financial products. This announcement does not constitute financial, tax or legal advice, nor is it an offer, invitation or recommendation to apply for or acquire a share in Qualitas or any other financial product. Before making an investment decision, readers should consider whether Qualitas is appropriate given your objectives, financial situation and needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser. Past performance is not a reliable indicator of future performance.

Qualitas results are reported under International Financial Reporting Standards (IFRS), which are used to measure group and segment performance. The presentation also includes certain non-IFRS measures. These measures are used internally by management to assess the performance of our business, make decisions on the allocation of resources, and assess operational management. All non-IFRS information unless otherwise stated has not been extracted from Qualitas’ financial statements and has not been subject to audit or review. Certain figures may be subject to rounding differences. Refer to Appendix A for the reconciliation of statutory earnings to normalised earnings. All amounts are in Australian dollars unless otherwise stated.

Appendix A – Reconciliation of restatement for FY23 financial and statutory financial to normalised financial